-

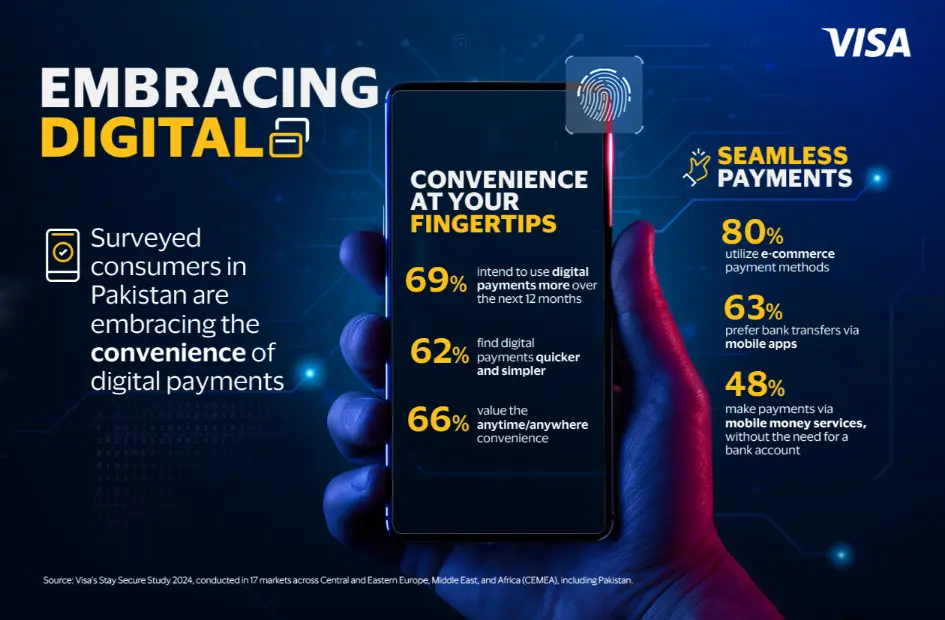

82% of consumers trust digital payments despite potential scams; 69% expect to use them more in the next 12 months

-

93% respondents worry their family, or friends might fall for a scam

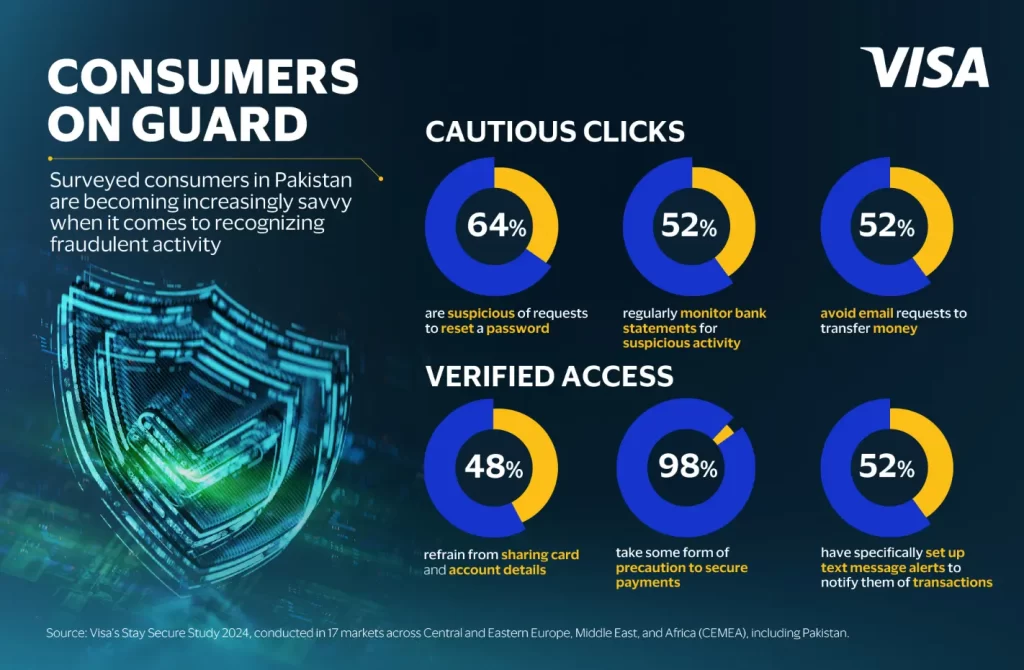

A new study commissioned by Visa reveals a rise in consumer awareness and proactive security measures for digital payments across Pakistan. The latest edition of Visa’s Stay Secure study, which surveyed 500 adults in the country, found that 98% of consumers now actively taking precautions to secure their online transactions, showcasing increased savviness as digital payments gain momentum.

While 55% of respondents in Pakistan acknowledge their vulnerability to scams like phishing, the increased adoption of security measures and preference for stronger authentication indicate a positive shift in consumer behavior since the last edition of the Stay Secure study in 2023.Consumers are now actively spotting red flags and verifying the legitimacy of online interactions, showing a marked increase in awareness.

Other key insights from the research indicate the continued acceleration of digital payments across the region, with over three-quarters of all respondents stating that they mostly or completely trust digital payments, regardless of the threat of fraud. As digital payments grow in use and popularity, there are steps that retailers, banks and payments processors can take to promote even greater trust, the study states.

Leila Serhan, Senior Vice President & Group Country Manager for North Africa, Levant & Pakistan, said: “The latest edition of Visa’s Stay Secure study affirms an increasingly sophisticated consumer base in Pakistan, one that is aware of potential security threats and actively engaged in safeguarding their digital transactions. This proactive approach, coupled with their sustained high trust in digital payments, even amidst fraud concerns, speaks volumes about the value and convenience digital payments offer across Pakistan. Visa’s ongoing efforts in consumer education are fundamental to maintaining and strengthening this trust. However, the threat of online scams is ever present and therefore it is important for consumers to remain vigilant.”

Key Findings of the Visa Stay Secure Study:

Susceptibility to Scams: 93% of consumers believe their friends or family would fall for a potential scam, especially if it’s a text message asking them to verify account information (56%).

Building Trust: Around 82% of respondents surveyed mostly or completely trust digital payments for making transactions. In fact, 85% Pakistanis feel more secure when required to enter a texted code or click on a link from the vendor to confirm their identity when making online payments.

Digital Payments Gain Traction: Consumers in Pakistan view these types of payments as quicker and simpler than other methods (62%) and appreciate that they allow them to make payments anytime, anywhere (66%).

Recognizing Scams: 45% of respondents consider themselves very or extremely knowledgeable when it comes to recognizing frauds and scams, a dip from 56% in the previous edition of the Stay Secure Study.

Ease of Use: 66% of Pakistani consumers value the anytime/anywhere convenience of digital payments. Overall, 69% intend to use digital payments more over the next 12 months.

The Stay Secure study is a part of Visa’s annual Stay Secure campaign, which reflects Visa’s commitment to raising consumer awareness, strengthening education, and building confidence to combat social engineering threats.

Visa’s Commitment to a Secure Digital Future

Visa has been at the center of AI in payments, investing $3.3 billion in AI and data infrastructure over the last decade. In 2024, it introduced three new AI-powered risk and fraud prevention solutions, as part of the Visa Protect suite, that are designed to help reduce fraud across immediate A2A and card-not-present (CNP) payments, as well as transactions on and off Visa’s network.

As the world’s largest SaaS platform, Visa combats cybercrime by deploying cutting-edge tools, expertise, and processes to help identify and mitigate fraud. The impact is undeniable: In the past year, Visa blocked $40 billion in fraudulent payment value prevented 80 million fraudulent transactions, and averted over $122 million in estimated e-commerce fraud through malware detection.

Also Read: Data Vault Launches the Pakistan’s First AI Data Center