To enhance customer satisfaction and streamline grievance redressal processes, the State Bank of Pakistan (SBP) has reintroduced its dedicated portal, Sunwai, to promptly address issues and complaints from bank customers.

The bilingual portal, designed to facilitate ease of use for the general public, enables individuals to file complaints against Banks, Microfinance Banks (MFBs), and Development Financial Institutions (DFIs) following applicable laws and regulations.

Accessible 24/7, the portal is complemented by a user-friendly mobile app, available for download on Google Play and the App Store. This mobile app empowers consumers to report grievances conveniently through their smartphones.

One notable feature of Sunwai is the ability for customers to track the progress of their complaints, offering transparency and assurance throughout the resolution process.

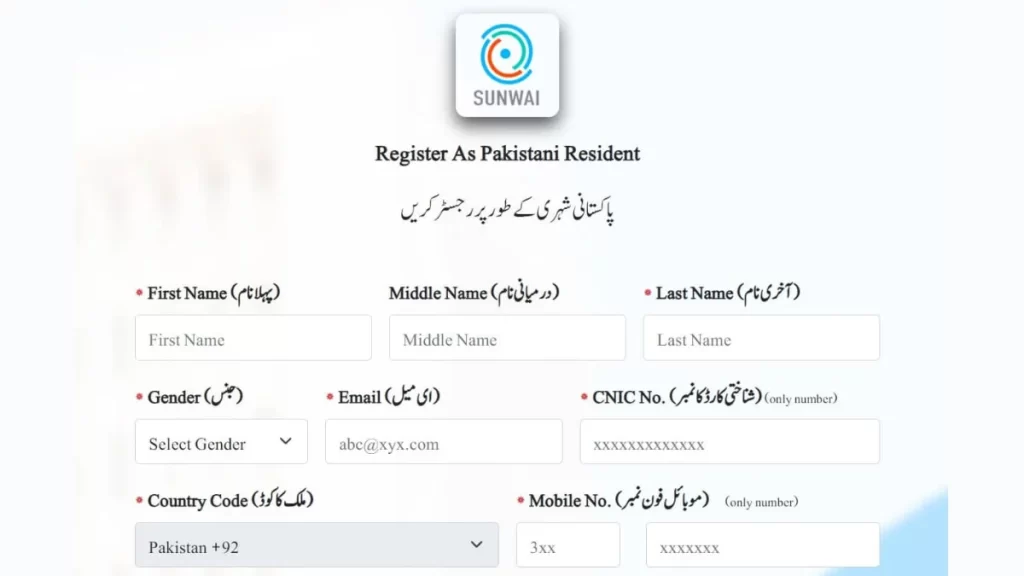

To lodge a complaint, users must register on the portal using personal details such as mobile number, CNIC, and email address. Once registered, consumers can easily submit their grievances by following a few straightforward steps.

The portal is designed to guide banking consumers through a hassle-free process by posing simple and concise questions. Complaints lodged through Sunwai can be directed to banks, MFBs, and DFIs as the primary resolution forum, with the Banking Mohtasib Pakistan (BMP) serving as the secondary forum, and in certain cases, the State Bank of Pakistan (SBP) itself.

Sunwai also features a complaint-tracking system and offers valuable consumer awareness tips and messages. A tutorial video is available to guide customers through the complaint registration process.

One of the noteworthy aspects of Sunwai is its commitment to expeditious issue resolution. Unlike the prevailing trends, where complaint resolutions may take up to 45 days or more, the portal aims to address customer concerns in a significantly shorter time frame.

With increased awareness of the Sunwai portal, customer complaints are anticipated to rise. However, this is viewed as a positive trend, as it signifies the growing effectiveness and responsiveness of the banking sector in addressing consumer concerns. The portal is expected to contribute to the overall enhancement of the quality of banking services in the foreseeable future.

Also Read: Businesses More Confident About Future Despite Insecurity: Gallup Survey