Startup funding landscape in Pakistan has experienced a challenging year, witnessing a significant downturn with investments plummeting to $75.6 million in 2023, as revealed by Data Darbar. This marks a substantial 77.2 percent year-on-year (YoY) decline compared to the same period last year.

The data further indicates that a notable portion of the funds, totaling $38.6 million, was raised in the fourth quarter of 2023, comprising 15 investments. Intriguingly, ten of these investment announcements were unveiled at Katalyst Labs’ +92 Disrupt.

The overall deal count for the calendar year recorded 37, showcasing a 47.9 percent YoY decrease. The average ticket amount also witnessed a significant drop to $2.4 million, representing a 60 percent decrease from the previous year.

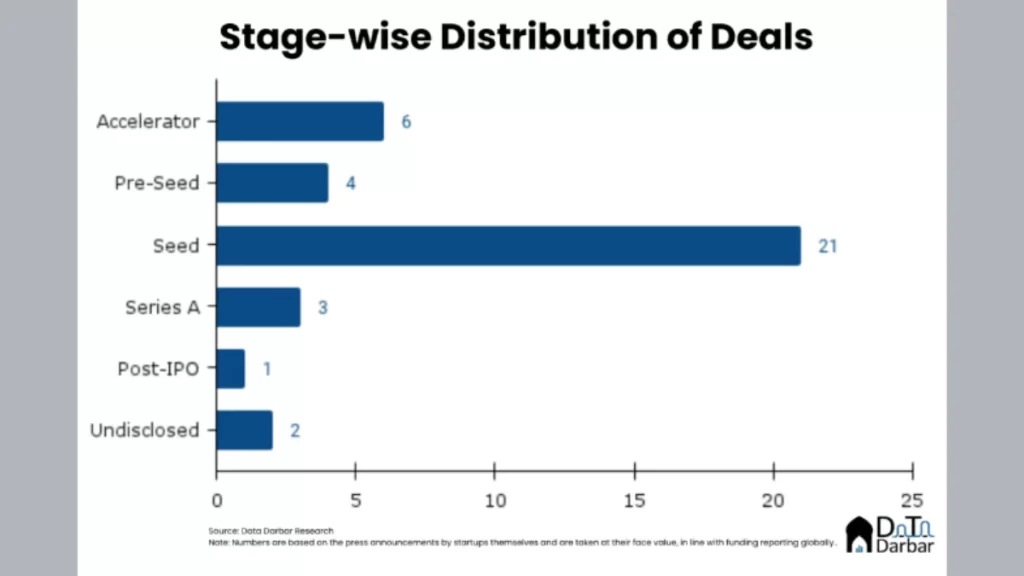

Seed funding rounds dominated the funding landscape, accounting for 21 out of the 37 deals and raising a total of $46 million throughout the year. Accelerator rounds, in contrast, numbered only six, accumulating a total of $1.8 million.

Series A rounds garnered $19.2 million, with Retailo’s bridge contributing $16.5 million. However, the report highlights challenges at the growth stage, where deals encountered difficulties or investors defaulted on their commitments.

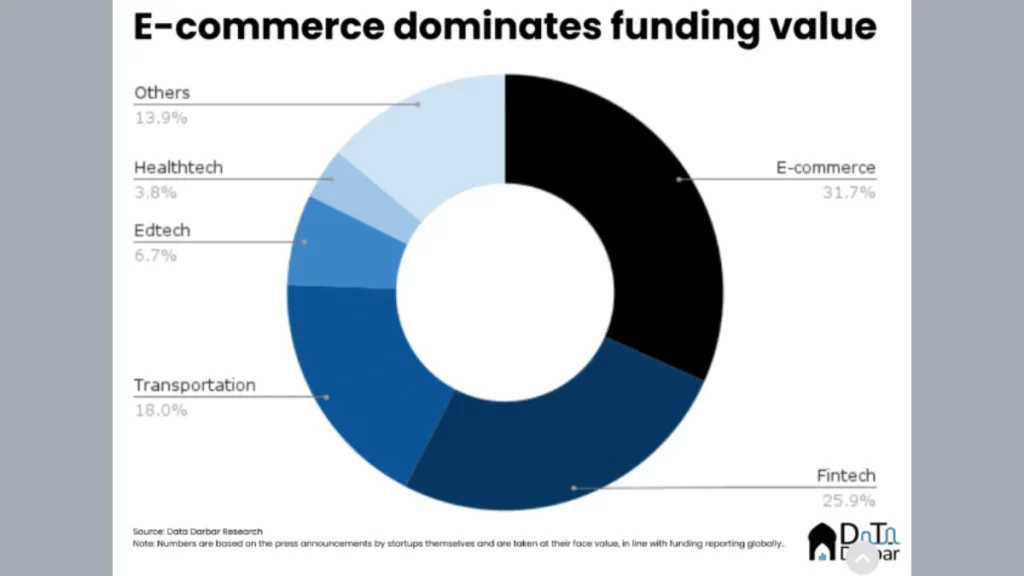

E-commerce emerged as the sector receiving the highest funding, amassing $23.95 million, with Retailo’s round making a significant contribution. Nonetheless, the report emphasizes that this figure may not entirely reflect the overall fundraising environment in the country.

Fintech secured the highest number of deals, totaling seven and valued at $19.6 million. Meanwhile, the transport and logistics sector received $13.6 million across six funding rounds.

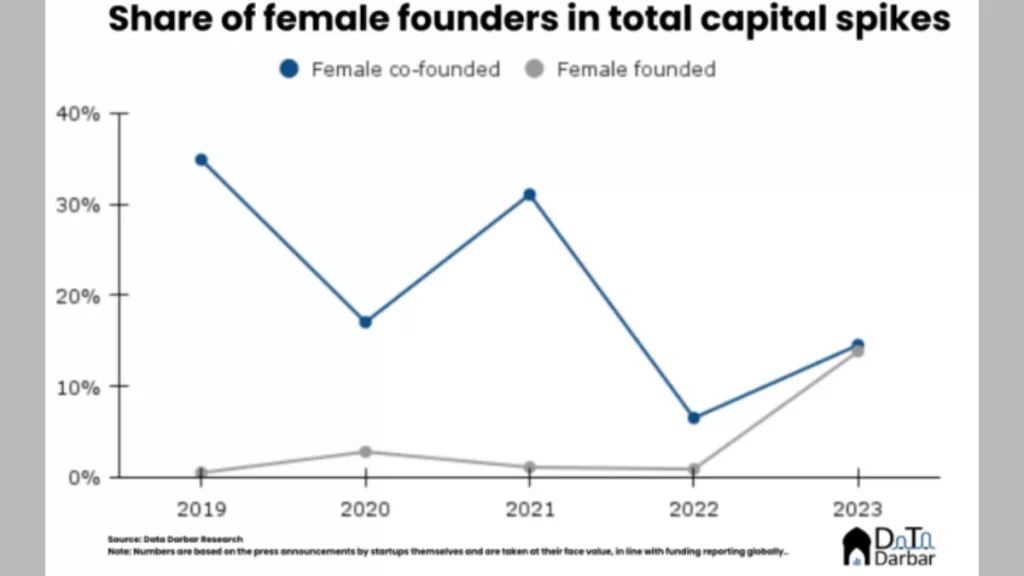

A notable highlight of 2023 was the substantial success of female-founded startups, attracting $10.5 million in funding. This marks a significant increase in their percentage of total investment, reaching 13.9 percent, a stark contrast to the average of 1.34 percent observed in 2019-2022.

Conversely, startups co-founded by females witnessed a decline in absolute dollar value to $11 million, constituting 14.5 percent of the total investment for the full year. The challenges and fluctuations in the funding landscape underscore the dynamic nature of Pakistan’s startup ecosystem.

Also read: Telecos Roll Out SIM Disowning Charges as PTA Crackdown Intensifies